Gross Margin Deep Dive

We believe that gross margin is one of the most critical line items on your P&L to get right because it’s arguably the most important line item that investors will use to determine the potential operating leverage in your business. Despite that, we find it is the most commonly miscalculated and misunderstood line item in founder-led SaaS P&Ls. Why? Because there’s often a bit of nuance to how the subcategories of cost of goods sold (“COGS”) are allocated. This post will explore:

a) How to calculate gross margin

b) Why investors care so much about it

c) A framework for benchmarking yours and

d) Methods for improving gross margin

How to Calculate It

At its most basic level gross margin is the percentage of revenue you retain after deducting the direct costs required to deliver that revenue. And so gross margin is calculated as follows: gross profit / revenue. Gross profit is equal to revenue minus the direct costs (cost of goods sold or “COGS”) required to deliver revenue. Seems simple right? Well, sometimes, but oftentimes no. Let’s breakdown the subcategories of COGS to understand why.

A typical SaaS business will have three major subcategories of COGS:

1) Hosting

This is usually the simplest to figure out. This is where you include any IT costs related to storing and hosting software and customer data, usually through third-party vendors. Think AWS spend. There can be material differences in how much hosting costs (e.g. single tenant vs. multi-tenant SaaS) between companies as a percentage of revenue but generally speaking companies tend to get this one right.

2) Personnel

This subcategory gets a bit trickier and is commonly misallocated as many companies mistakenly allocate some or all of this subcategory below COGS to SG&A. COGS personnel should include the fully burdened salaries (i.e. make sure to include employee benefits and payroll taxes) of any employees who are providing ongoing customer support (i.e. “customer success”) and/or onboarding new customers as part of the implementation process (i.e. “professional services”). Importantly, if customer support and/or success personnel spend time on renewal or upsell then that portion of their time utilization can be allocated to SG&A instead of COGS.

3) Other 3rd Party Licenses

This is a bit of a miscellaneous bucket that includes all other IT costs required to provide the products on an ongoing basis outside of hosting. Think of things like one-time data migration costs during onboarding, customer data security monitoring, payment processing, etc. To be clear this doesn’t mean all 3rd party software licenses - just those that are required to maintain service for current customers; i.e. your CRM software subscription resides in operating expenses.

And so COGS = hosting + allocated personnel costs + other 3rd party licenses. Divide COGS for each period by revenue for that period and you have your gross margin.

Why Do Investors Care So Much About Gross Margin?

We find that many founders have a hard time understanding the investor fixation on gross margins. If customer support for example has to be reallocated from operating expenses to COGS cash flow doesn’t change. So why the investor obsession?

Gross Margin is Difficult to Improve

The primary reason that investors fixate so much on gross margin is that of all the expense line items it is the most “locked” and so has the greatest measurable impact on the cash flow generation ability of a SaaS business at maturity. What does this mean exactly? It means for a SaaS business it’s relatively difficult to optimize COGS vs. the other expense line items. I.E. operating expenses as a percentage of revenue tends to decline materially over time as a SaaS business progresses through the “J-curve” of profitability vs. gross margin which may have some wiggle room for incremental efficiency (more on that below) but is usually fairly stable as a SaaS business scales. Sometimes there is even downward pressure on gross margin over time as it becomes more and more difficult to efficiently manage numerous multi-tenant customers across an ever-expanding product suite.

Impact on LTV / CAC

Recall also that arguably the single best heuristic of a SaaS business’s unit economics is Lifetime Value / Customer Acquisition Cost (“LTV / CAC”). LTV is directly impacted by gross margin as LTV = (Average Revenue per Customer x Gross Margin) / Churn Rate. So you can see the lower the gross margin the worse the unit economics. This has a huge impact on how investors think about how quickly a business can scale to profitability and to what level. An unprofitable business with a 70% gross margin (holding all else equal) will not scale to profitability as quickly or to the same level as a business with a 80% gross margin.

Impact on Ability to Invest into Growth

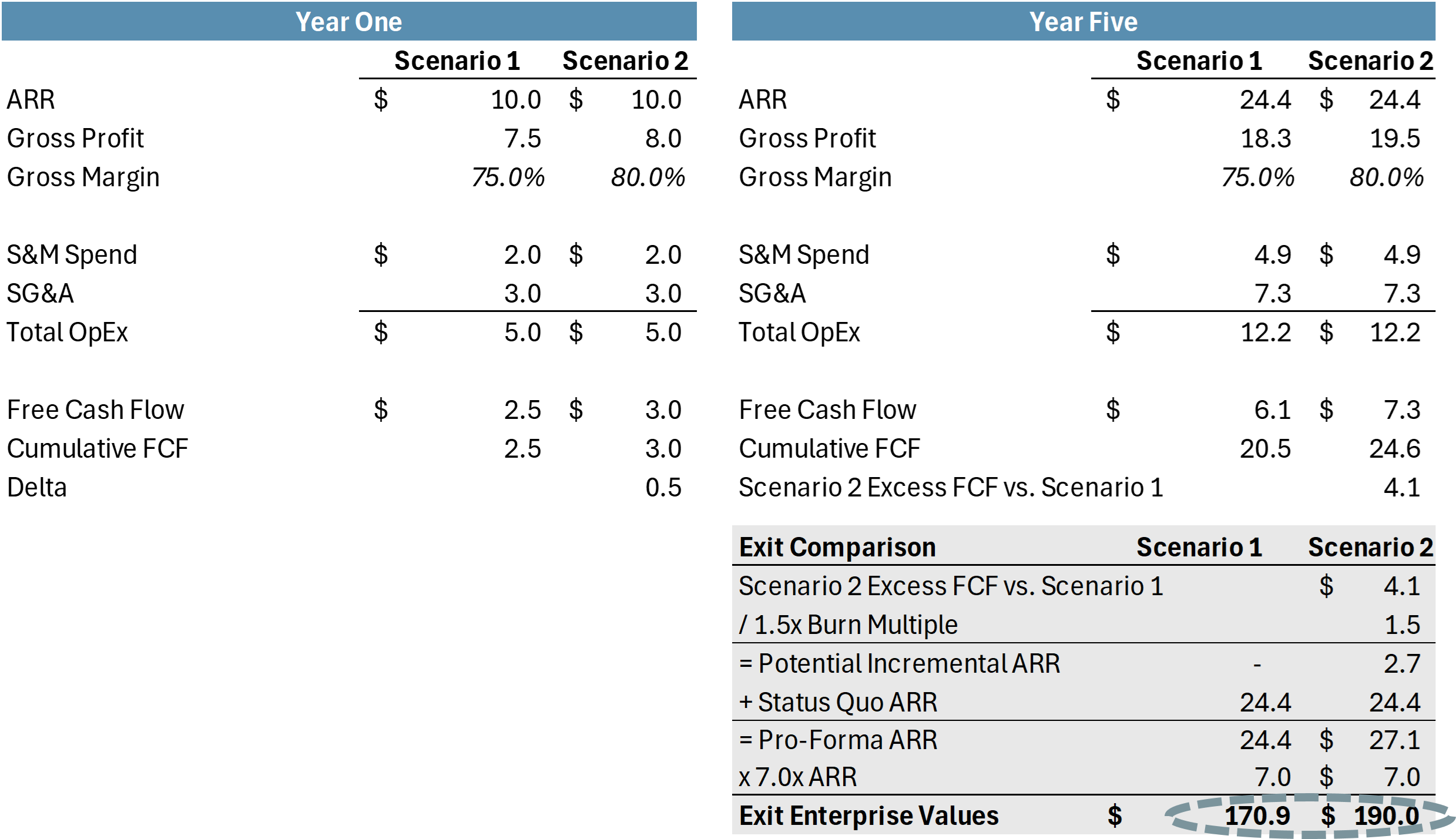

Gross profit provides the dollars available for growth (i.e. gross profit dollars fund S&M and SG&A). So it follows that a lower gross margin leads to lower dollars available to drive growth. Recall that until a SaaS company reaches full maturity its primary valuation metrics are Enterprise Value / ARR and Enterprise Value / Revenue. Less gross profit means less dollars available for customer acquisition meaning lower ARR / Revenue and so by definition a lower Enterprise Value at exit. The math below provides a simple illustration of the impact that an 80% gross margin has on an exit vs. 75% assuming same growth rates and operating expense margins with a 1.5x “Burn Multiple” (Net Burn / Net New ARR):

Note that the 80% gross margin scenario has $4.1M more FCF available to invest into growth than the 75% gross margin scenario and so assuming the 1.5x burn multiple the 80% scenario could realize $2.7M more in ARR by exit which, assuming a 7.0x ARR multiple for both scenarios, means nearly $20M more in enterprise value at exit.

Signal Effect

Beyond the math, a SaaS business with high gross margin also provides positive signals across multiple strategic dimensions such as pricing power (i.e. high ROI for the customer), easy to support products, and efficient and scalable IT infrastructure. Low gross margin might mean a business is cutting prices to win new logos or having to over hire customer support staff to address a clunky UI.

Benchmarking Gross Margin

The graphic below provides a high-level overview of how investors think about varying levels of gross margin:

That said, like a lot of software metrics, caveats apply. Companies who have a high percentage of revenue as payments typically have lower gross margins as they incur additional direct costs like interchange fees, payment processing costs, and the need for robust security measures. Companies that sell into large enterprise may have lower gross margins due to larger implementation and/or customer success teams. For these reasons it’s usually prudent to break out your gross margin by revenue line item such that investors can better understand gross margin for subscription software vs. the other revenue contributors. This is obviously much more important for businesses whose blended gross margin is being weighed down by services and/or payments.

Methods for Improving Gross Margin

Reduce Hosting & 3rd Party Software Costs

Many early-stage SaaS companies outgrow their hosting and 3rd party software contracts quickly and sometimes neglect to renegotiate and/or explore other vendors during contract renewals. It’s important to benchmark your spend against other SaaS companies of your size to ensure you aren’t overspending on IT. SaaS Capital publishes an outstanding spend survey on private SaaS companies the latest of which found that the median hosting spend is 5% of ARR.

Streamline Services

Implementation services and customer support can become a large drag especially for early-stage SaaS companies who may have hired large teams in anticipation of future growth. For customer support there may be opportunity to implement AI-driven chatbots, ticket auto-tagging, and predictive analytics to prioritize and resolve issues faster with lower headcount. That said, we believe that retention should be the priority vs. automating customer support tasks too quickly as investors may be willing to extrapolate lower customer support COGS over time but are generally much less willing to look past retention issues due to poorly executed customer support.

High-Margin Upsell

Launching ancillary products can be the fastest way to improve gross margin. When we work with our clients on positioning their P&Ls to investors we like to pro-forma potential gross margin expansion from new products - too many advisors take a simplistic approach and assume a steady state gross margin even as new products come online in the forecast period. It’s important to take a more granular approach in determining what the incremental COGS from new products will be to present your forecasted gross margin in the best possible light.

Refine your Ideal Customer Profile (“ICP”)

Many early-stage SaaS companies fail to properly target their ICP in lieu of signing up any customers they can which ends up having a negative impact on a number of SaaS KPIs including gross margin. Customers that are not the right ICP tend to be more price sensitive and/or require greater handholding (i.e. more customer support cost) to stay happy with the platform.

Conclusion

Hopefully this post was helpful in demystifying how to correctly calculate gross margin, why it matters so much, and a few methods for improving it. As always, please reach out with any questions!